How can we help you?

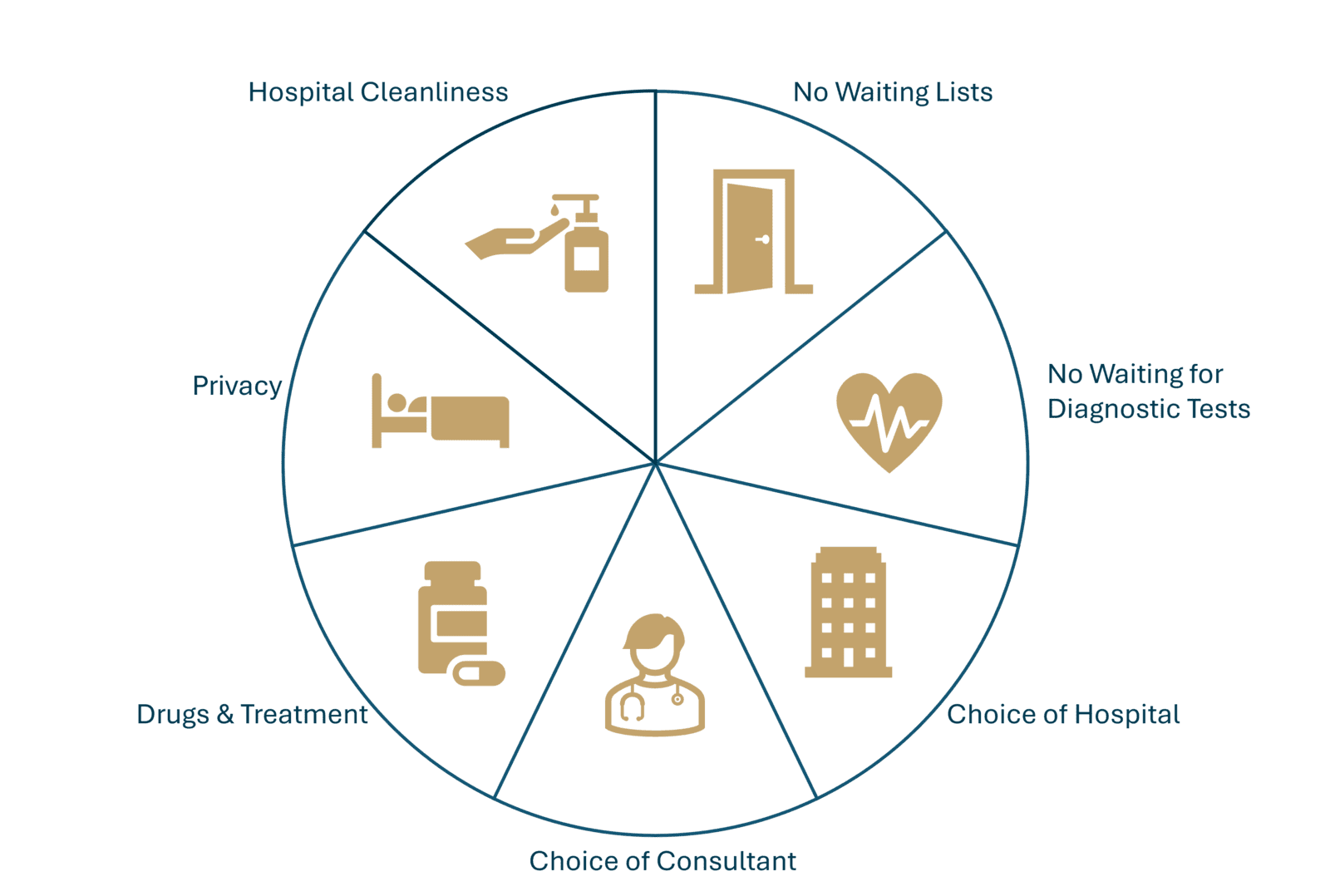

Do I need Private Medical Insurance?

You need private medical insurance to access faster diagnosis and treatment, avoid long waiting times, and receive care in private hospitals or facilities. This insurance provides coverage for medical expenses such as specialist consultations, surgeries, and diagnostic tests, often including options for additional treatments not typically available through our NHS. It’s especially beneficial if you want greater control over your healthcare, choice of doctors, and flexibility in scheduling appointments, ensuring timely and quality medical attention when needed.

Don't become a statistic on a waiting list when you need medical attention.

Do I need Income Protection?

You need income protection insurance to safeguard your finances if you're unable to work due to illness, injury, or disability. This type of insurance provides a regular income, typically a percentage of your salary, to help cover essential expenses like mortgage or rent, bills, and daily living costs while you're recovering. It's especially important if you don't have substantial savings, sick pay from your employer, or alternative sources of income, as it ensures financial stability during challenging times.

YOU are your most important asset - Protect yourself first!

Why do I need Life Insurance?

You need life insurance to provide financial security for your loved ones in case you pass away pre-maturely. It ensures that your family or dependents can cover essential expenses such as mortgage payments, daily living costs, education fees, or outstanding debts. Life insurance can also help preserve your family’s standard of living, fund future goals, and provide peace of mind knowing they will have financial support in difficult times. It’s particularly important if you have dependents, financial obligations, or want to leave a legacy.

We think of it as Love Insurance

Why do I need to consider Serious Illness Insurance?

This insurance pays out a lump sum that can be used to cover medical expenses, make up for lost income, or adapt your lifestyle to accommodate your recovery. It's particularly important if you don't have sufficient savings or other financial safety nets, as it helps ease the financial burden during a difficult time, allowing you to focus on your health and recovery.

The NHS and your basic medical savings is not enough.

Do I need to consider Serious Illness Cover for my child?

Serious illness cover for children provides financial support if your child is diagnosed with a critical illness, helping to cover medical expenses, reduce work commitments, and manage unexpected costs during a challenging time.

Financial peace of mind when your child's health is the only thing on your mind.

Should I consider using a Trust?

Probate is the process where your estate (everything you own) is divided up according to your wishes if you have a will or the Laws of Intestacy if you don't. This is a notoriously lengthy process, usually longer than 6 months, delaying the payment of your life policy until completed. A Trust is essentially a legal arrangement where the Trust takes ownership of certain assets, like your life policy. This means your life policy is not subject to probate and will pay to your beneficiaries immediately after your death.

Trusts can be a powerful tool for managing and protecting assets.

Is it necessary to write a will if I don't have many assets?

In the UK it is important to have a will regardless of the size of your estate. A will provides clarity and ensures your wishes are follwed after your death. If you die intestate (without a will), your assets will be distributed according to the intestacy rules, which prioritise your close relatives and excludes unmarried partners, step children and friends. If you do not have any close relatives, your estate will go to the Crown (the government).

Respecting your wishes provides peace of mind for you and your loved ones.

Who needs a Lasting Power of Attorney?

Simply put, it's beneficial for anyone who wants to plan for the future. A LPA is a legal document that allows you to appoint someone you trust to make decisions on your behalf if you lose the capacity to do so. There are two types of LPA namely, Property and Financial Affairs and Health & Welfare LPA.

Financial peace of mind when your child's health is the only thing on yoru mind.

How can we help your business?

How does Private Medical Insurance benefit my business?

Private Medical Insurance (PMI) as an employee benefit is a health insurance policy provided by an employer to their staff, offering them access to private healthcare services. It compliments the NHS by reducing wait times and providing more comprehensive treatment options, which in turn speeds up recovery and improves employee absenteism.

Demonstrate a commitment to employee health and wellbeing, and you'll have improved job satisfaction and loyalty.

Do I need Income Protection for my employees?

Income Protection as an Employee Benefit provides financial support to employees unable to work due to illness or injury. It typically covers 50–75% of their salary, offering regular payments during extended absences. Employers usually pay the premiums, making it a tax-efficient way to support employees. It complements sick pay by offering long-term financial support and reinforces a workplace culture that values employee well-being.

Ensures financial security for your employees and attracts talent with competitive employee benefits.

Why do I need Life Insurance for my employees?

Life Insurance as an Employee Benefit, also known as Group Life Insurance or Death in Service Benefit, provides a tax-free lump sum to an employee’s beneficiaries if they pass away during their employment. It’s a valuable addition to benefits packages, showing care for employees and their families while improving workplace satisfaction.

Attracts talent, enhances retention, boosts morale, and is cost-effective

Why do I need to consider Serious Illness Insurance for my employees?

Serious Illness Insurance as an Employee Benefit provides a tax-free lump sum to employees diagnosed with a critical condition like cancer, heart attack, or stroke. Funded by the employer, it offers financial support for medical expenses, recovery, or personal needs.

Provides additional support, demonstrating care for employees' well-being during challenging times.

Do I need Shareholder Protection?

This is an important consideration when a business has multiple shareholders. It ensures that, in the event of a shareholder’s death, critical illness, or permanent disability, the remaining shareholders retain control of the business and the affected shareholder’s family or estate is fairly compensated.

Paired with a clear Shareholders’ Agreement, it provides financial security and clarity during challenging times.

Does my business need KeyPerson Insurance?

This is a form of business insurance designed to protect your company if a key individual, essential to its success, becomes unable to work due to death, critical/serious illness or permanent disability. There are several factors to consider, mainly, if the absence of a key individual would have a significant financial impact to your business, then this policy is a vital risk management tool.

Provide your business with the financial resources to recover from the unexpected loss of key talent.

What is a Relevant Life Plan (RLP)?

This insurance policy is specifically beneficial for small businesses, to provide life cover for directors and high-earning employees in a tax efficient manner. It not only supports employee financial wellbeing but also offers significant tax advantages for both the business and the insured individual under current HMRC guidelines.

Ideal if you want to offer competitive employee benefits.

When will my business insurance need a Trust?

In the UK, business insurance policies generally should be placed in a trust, however there are specific scenarios when a trust should and should not be used. There are two types of trust to be consdiered, a Bare (or Absolute) Trust and a Discretionary Trust (most commonly used).This question will require advice from one of our insurance planners.

A trust is tax efficient, protects the pay-out from creditors and controls how the funds are distributed.

What Other Insurance Products do we offer?

What is Home & Contents Cover?

You need private medical insurance to access faster diagnosis and treatment, avoid long waiting times, and receive care in private hospitals or facilities. This insurance provides coverage for medical expenses such as specialist consultations, surgeries, and diagnostic tests, often including options for additional treatments not typically available through our NHS. It’s especially beneficial if you want greater control over your healthcare, choice of doctors, and flexibility in scheduling appointments, ensuring timely and quality medical attention when needed.

Don't become a statistic on a waiting list when you need medical attention.

Do I need Income Protection for my employees?

You need income protection insurance to safeguard your finances if you're unable to work due to illness, injury, or disability. This type of insurance provides a regular income, typically a percentage of your salary, to help cover essential expenses like mortgage or rent, bills, and daily living costs while you're recovering. It's especially important if you don't have substantial savings, sick pay from your employer, or alternative sources of income, as it ensures financial stability during challenging times.

YOU are your most important asset - Protect yourself first!

What some of our most satisified clients have to say...

Peter assisted us with Life and Serious Illness cover a few years ago. This year, my husband was diagnosed with Cancer. Such a shock! Thanks to Peter and the cover he put in place for us, my husband was able to focus on his treatment and recovery without having to stress about not having an income.

I highly recommend Peter, he's professional, communicates well and on time, compassionate, thoughtful, meticulous, makes sure all bases are covered.

Ncumisa

What some of our most satisified clients have to say...

Jenine provided a very professional and thorough service. She is very knowledgeable about her field and handled the whole process smoothly.

It is worth speaking to a professional about will writing, as there are many possible pitfalls in writing a will properly. The pricing is market related, but the service was excellent. Don't try to save pennies now and then pay dearly later. Jenine is highly recommended.

Tom

What some of our most satisified clients have to say...

Peter was fantastic in keeping me posted on the progress of our applications. His detailed knowledge of all his products was exceptional - answering all my questions with patience. Thank you Peter, I am feeling a lot less stressed knowing we'll be sorted if anything happens to us!

Adi

What some of our most satisified clients have to say...

Jenine was professional, friendly and very knowledgeable. She guided us through the process and made every step as easy as possible. We would highly recommend Jenine for your Wills and Estate Planning.

Stav

What some of our most satisified clients have to say...

Sandy helped me navigate through the private medical insurance options to create a unique benefit for our employees. Offering the best employee benefits of medical insurance and life cover has improved our retention of employees by 200% over the last 2 years, not to mention the improved reduction in absenteeism.

Her knowledge, patience and most of all reliability have been greatly appreciated by every one of our team. I look forward to many more years as a client of MacIntosh LFS.

Susan

What some of our most satisified clients have to say...

Peter came to see me in London after he had made recommendations to my wife regarding our Life and Protection Planning needs. Peter has communicated the value proposition of the product and areas it covers clearly and concisely. Peter is knowledgeable and is able to communicate that in a manner that took our needs into account. I would happily recommend Peter if you are looking for a long term, relationship based Financial Planning exercise.

Anton

What some of our most satisified clients have to say...

Jenine has been incredible in assisting us with our Will.

Very patient and explained the process from start to finish.

We recommend Jenine’s services 100%.

Nat

What some of our most satisified clients have to say...

Peter has been incredible, he is an expert in his field and helped us to navigate the unfamiliar territory of signing up for UK life insurance and the associated risk benefits. Peter took the time to review our personal details carefully and gave us a comprehensive quote and explained all of the information in detail. We had a bit of a complicated case and Peter fought to ensure that we ended up with the best cover at the best rate given the circumstances.

Peter and Jenny are phenomenal at what they do and you can truly see that they genuinely care about their clients and go above and beyond to meet their expectations.

Jessica

What some of our most satisified clients have to say...

I’ve always dreaded reviewing my insurance and often put it off for years. That changed when I met Sandy four years ago. She helped me find the perfect private medical insurance for my family, and her meticulous attention to detail and determined approach quickly earned my absolute trust. Today, Sandy manages all our insurance needs—family, business, and personal.

Do I recommend her and MacIntosh LFS? Without a shadow of a doubt - 100%!

Mike L

What some of our most satisified clients have to say...

Jenine was an absolute pleasure to work with and she guided us through the whole process with ease. She is incredibly knowledgeable in her field, and we feel confident knowing our wills have been drafted by an expert. I would not hesitate to recommend her services.

Taryn

What some of our most satisified clients have to say...

I would like to thank Dean Phillips for the consistent professional service in life and vitality. I needed a better health insurance cover that was sadly lacking with my previous contract, I contacted Dean who came out to where I was working and delivered a presentation to myself about all the benefit’s of having the right cover and insurance for myself. Dean is a superb professional in his field of expertise and I would not hesitate to recommend Dean to any of my friends or contacts Once again thank you for your wonderful service.

Darrel

What some of our most satisified clients have to say...

Jenine assisted both my husband and myself with our wills in the UK. She is incredibly knowledgeable, helpful & efficient. The whole process was painless. I highly recommend her services.

Leander